How surcharges work in policies

Picture this: You're cruising down the highway, windows down, favorite tunes blasting, when suddenly, your mailbox delivers a not-so-friendly surprise—a heftier bill from your auto insurance company. Yeah, that's the sneaky world of surcharges creeping in. As someone who's navigated the twists and turns of car insurance myself, I get how frustrating it can be to unwrap these extra fees. Today, we're diving into how these surcharges actually work in auto policies, keeping things light and straightforward, like a casual chat over coffee.

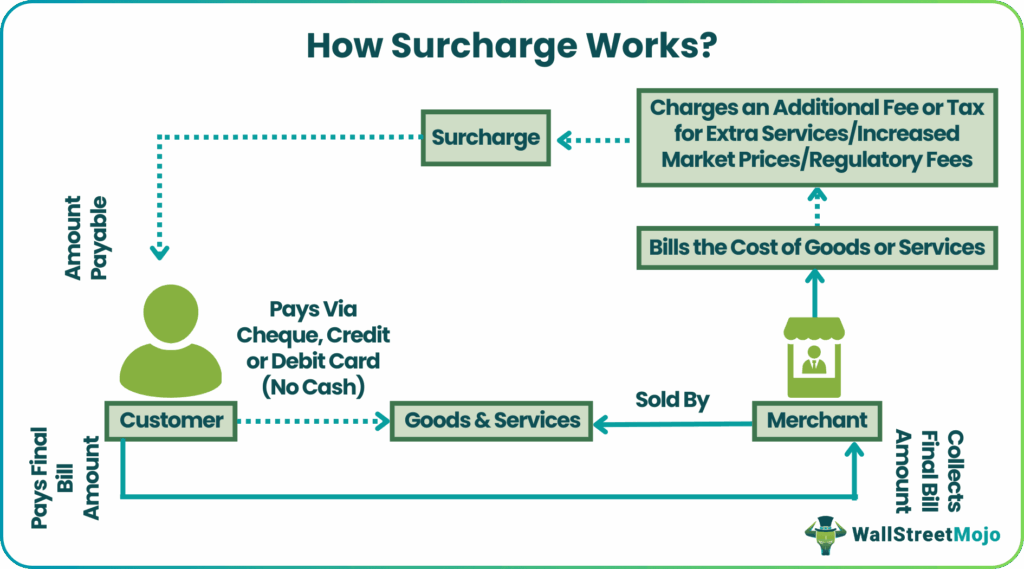

How surcharges work in auto insurance policies is basically your insurer's way of tacking on extra costs for certain risks or slip-ups. In a nutshell, if you've got factors that make you a higher risk driver, like a fender-bender or a speeding ticket, they might add these charges to your premium. For instance, a common surcharge could bump up your monthly payment by 20-30% for a few years, depending on your policy details. It's their method to balance the books while keeping coverage afloat, but don't worry—understanding this can help you steer clear of unnecessary hits to your wallet.

Let's break it down further. Auto insurance isn't just about the base rate; it's layered with these potential add-ons that can feel like unwelcome passengers in your policy ride. Imagine your policy as a custom-built car—surcharges are those optional features that cost extra if you opt in, even if you didn't mean to. From my own experience, I once got hit with a surcharge after a minor parking scrape, and it turned what was supposed to be a quick fix into a lingering expense. These fees aren't arbitrary; they're calculated based on data, like your driving history or even where you park your car overnight.

What Triggers Surcharges in Your Auto Policy?

Okay, so why do these surcharges pop up? It's often tied to behaviors or events that insurers see as red flags. For auto insurance, common culprits include accidents, traffic violations, or even claims you've filed. Think of it like your insurance provider playing detective— they're scanning your record for anything that screams "higher risk." A speeding ticket, for example, might lead to a surcharge because it suggests you're more likely to get into a wreck. And here's a fun fact from the insurance world: in the U.S., about 40% of drivers face at least one surcharge in their lifetime, often linked to something as everyday as a distracted driving incident. It's like that meme of the cat knocking over a vase—oops, now everyone's paying attention.

Top considerations for policy expirationBut it's not all doom and gloom. Surcharges vary by state and company, adding a layer of regional flavor to auto policies. In places like California, where traffic is a beast, surcharges for DUIs can skyrocket your premiums. On a lighter note, if you're a safe driver with a clean record, you might dodge these fees altogether, turning your policy into a smooth, surcharge-free drive.

Now, let's get into the nitty-gritty: surcharges don't just vanish; they can inflate your premium for years. For auto insurance, a typical surcharge might add $100 to $500 annually, depending on the severity. It's like that unexpected toll booth on your road trip—suddenly, your budget's taken a detour. Insurers use actuarial tables, which are basically fancy spreadsheets of risk data, to decide how much to add. If you've ever wondered why your friend's insurance is cheaper, it's probably because their driving history is as spotless as a freshly waxed car.

To put it in perspective, here's a quick comparison table of how surcharges might play out for different scenarios in auto insurance:

| Scenario | Typical Surcharge Impact | Duration |

|---|---|---|

| Minor Accident (No Injuries) | 10-20% increase in premium | 3-5 years |

| Speeding Ticket | 15-25% increase | 3 years |

| DUI Conviction | 50% or more increase | Up to 10 years |

This table shows how surcharges in auto policies aren't one-size-fits-all; they're tailored to the risk, making it crucial to shop around and maybe even take a defensive driving course to cut those costs.

Top considerations for policy expirationTips to Dodge or Soften Those Auto Policy Surcharges

If you're tired of these extras weighing down your auto insurance, there are ways to fight back. Start by reviewing your policy annually—it's like giving your car a tune-up to keep everything running smoothly. One trick I've used is bundling my auto insurance with home coverage, which often nets a discount that offsets potential surcharges. Plus, maintaining a good credit score can influence rates, as insurers in many states factor that into their equations.

Another angle: consider usage-based insurance programs. These track your driving habits via an app or device, and if you're the type who sticks to the speed limit and avoids late-night drives, you could waive surcharges altogether. It's almost like turning your daily commute into a game where safe driving earns you points—and savings.

Wrapping Up with a Thought on Your Auto Insurance Journey

As we ease out of this chat, think about how understanding surcharges can transform your auto insurance from a headache into a tool for smarter decisions. Maybe it's time to ask yourself: What's one change I can make today to keep my premiums in check? Whether it's brushing up on safe driving or comparing policies, you're in the driver's seat. And hey, here's to smoother roads ahead—no surprises required.

FAQ: Quick Answers on Auto Insurance Surcharges

1. Can I negotiate surcharges on my auto policy? Absolutely, many insurers are open to discussions, especially if you have a clean record afterward. It's worth calling your agent to explain your situation—they might reduce or remove it based on your history.

Guide to accident forgiveness options2. How long do surcharges last in auto insurance? It varies, but most stick around for 3 to 5 years, though serious violations like DUIs can extend that. Keeping a spotless record post-incident helps them fade faster.

3. Do all auto insurance companies charge the same surcharges? No, rates differ widely, so shopping around is key. Factors like your location and provider's policies play a big role in what you'll pay.

Si quieres conocer otros artículos parecidos a How surcharges work in policies puedes visitar la categoría Car Insurance.

Entradas Relacionadas