Guide to insurance for leased vehicles

Ever had that moment when you're signing on the dotted line for a shiny new leased car, and suddenly the dealer hits you with a barrage of insurance talk? Yeah, me too—it felt like trying to navigate a maze blindfolded. I once leased a little SUV for a road trip, only to realize my standard policy wouldn't cut it. That's the spark that got me diving deep into the world of insurance for leased vehicles. It's not just about ticking boxes; it's about peace of mind on the road. Let's kick back and unpack this together in a laid-back way, because who says dealing with insurance has to be a headache?

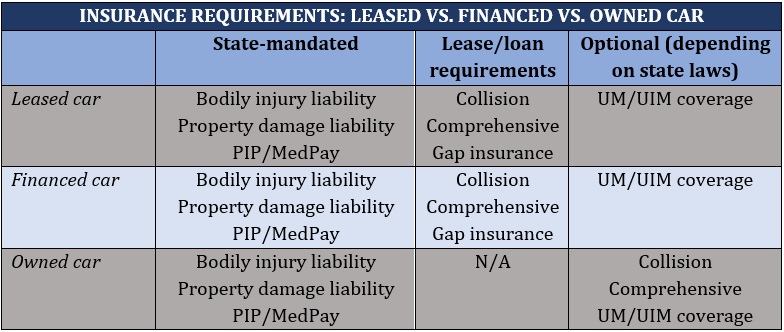

Insurance for leased vehicles is essentially your safety net when you're not the full owner of the car. You'll typically need more comprehensive coverage than for a car you own outright, as leasing companies want to protect their asset. Think of it like borrowing your buddy's favorite jacket—you've got to make sure it comes back in one piece. This guide will walk you through the essentials, helping you avoid surprises and keep things smooth.

Why Bother with Extra Insurance for Your Leased Ride?

Picture this: you're cruising down the highway, music blasting, when bam—fender bender. For leased cars, the stakes are higher because the leasing company holds the title. They often require you to maintain full coverage to cover any potential damages, which could otherwise come out of your pocket at the end of the lease. From my own mishap, I learned that skimping on insurance can turn a fun lease into a financial nightmare. Key reasons include protecting against theft, accidents, and even natural disasters, ensuring you're not left holding the bag for repairs or replacements.

Plus, many leases mandate specific limits on liability and collision coverage to meet state laws and company policies. It's not just about you; it's about safeguarding everyone's interests. And hey, with rising car values, having solid insurance can actually save you money in the long run by preventing hefty end-of-lease charges.

Common issues with add-on featuresBreaking Down the Coverage Options You'll Need

When it comes to car insurance for leased vehicles, think layers of protection like an onion—peel back each one for the full picture. Start with liability insurance, which covers damages you cause to others, because nobody wants a lawsuit looming. Then there's collision coverage for when you smack into something, and comprehensive for non-accident issues like theft or hail storms—essential for leased cars since the lessor will inspect it thoroughly at the end.

Don't overlook gap insurance, a leased vehicle favorite. It's that sneaky add-on that bridges the gap between what you owe on the lease and the car's actual value if it's totaled. I remember wishing I'd had it during my SUV lease; it could have saved me from unexpected costs. Other perks might include rental reimbursement if your car's in the shop, or even roadside assistance for those "oh no" moments. Mixing and matching these based on your lease agreement keeps things tailored and stress-free.

How to Score the Right Insurance Without the Hassle

Getting insured for a leased car doesn't have to feel like climbing a mountain. Here's a relaxed step-by-step to guide you:

1Review your lease agreement first—spot the insurance requirements so you know exactly what to ask for.

Benefits of loyalty programs in insurance2Shop around online or through agents; compare quotes from multiple providers using tools like those on insurance comparison sites—it's like window shopping, but for peace of mind.

3Double-check for discounts, like bundling with home insurance or safe driver perks, to keep costs down without cutting corners.

4Finalize with your insurer, making sure the policy explicitly covers your leased vehicle and meets the lessor's standards—think of it as sealing the deal on a new adventure.

Traps to Dodge on Your Insurance Journey

In the spirit of keeping it real, let's chat about common slip-ups. One biggie is assuming your personal auto policy will suffice—spoiler: it often doesn't for leased cars, leading to denied claims. Another is overlooking the mileage limits in your lease, which can affect your premiums if you rack up extra miles. And don't forget about modifications; if you jazz up your leased ride with fancy rims, that could void coverage or hike your rates. From my anecdote, skipping the fine print was my biggest regret—learn from it and stay ahead.

Myths about gender-based rates| Coverage Type | For Owned Vehicles | For Leased Vehicles |

|---|---|---|

| Liability | Basic protection | Often higher limits required |

| Collision | Optional | Usually mandatory |

| Gap Insurance | Rarely needed | Highly recommended |

Quick Tips for a Smoother Ride

While we're on a roll, keep an eye on your policy annually; life changes like moving states can tweak your insurance needs. And if you're into that, check out memes on social media about leasing woes—they're hilariously relatable and remind us not to take it all too seriously.

FAQs on Leased Vehicle Insurance

What happens if I don't get the required insurance? You could face lease violations, extra fees, or even lease termination—it's like ignoring a warning light on your dashboard; things can escalate quickly.

Can I cancel my insurance if I return the vehicle early? Absolutely, but coordinate with your insurer to avoid any overlap charges and get a refund for unused time—it's a straightforward process once you chat with them.

Is insurance more expensive for leased cars? Generally yes, due to the need for fuller coverage, but shopping smart can keep it affordable—think of it as the premium for that new-car smell without the full ownership commitment.

Solutions for policy gaps during movesAs we wrap up this casual chat, imagine glancing in your rearview mirror at the road behind— you've got the tools to handle insurance like a pro. What if you turned this knowledge into your next smart move, like negotiating a better lease deal? It's all about driving forward with confidence.

Si quieres conocer otros artículos parecidos a Guide to insurance for leased vehicles puedes visitar la categoría Car Insurance.

Entradas Relacionadas